Is Back Door Roth Available In 2024. Is the backdoor roth ira still allowed? Rather, it’s a strategy that helps you move money into a roth ira even though your annual income would.

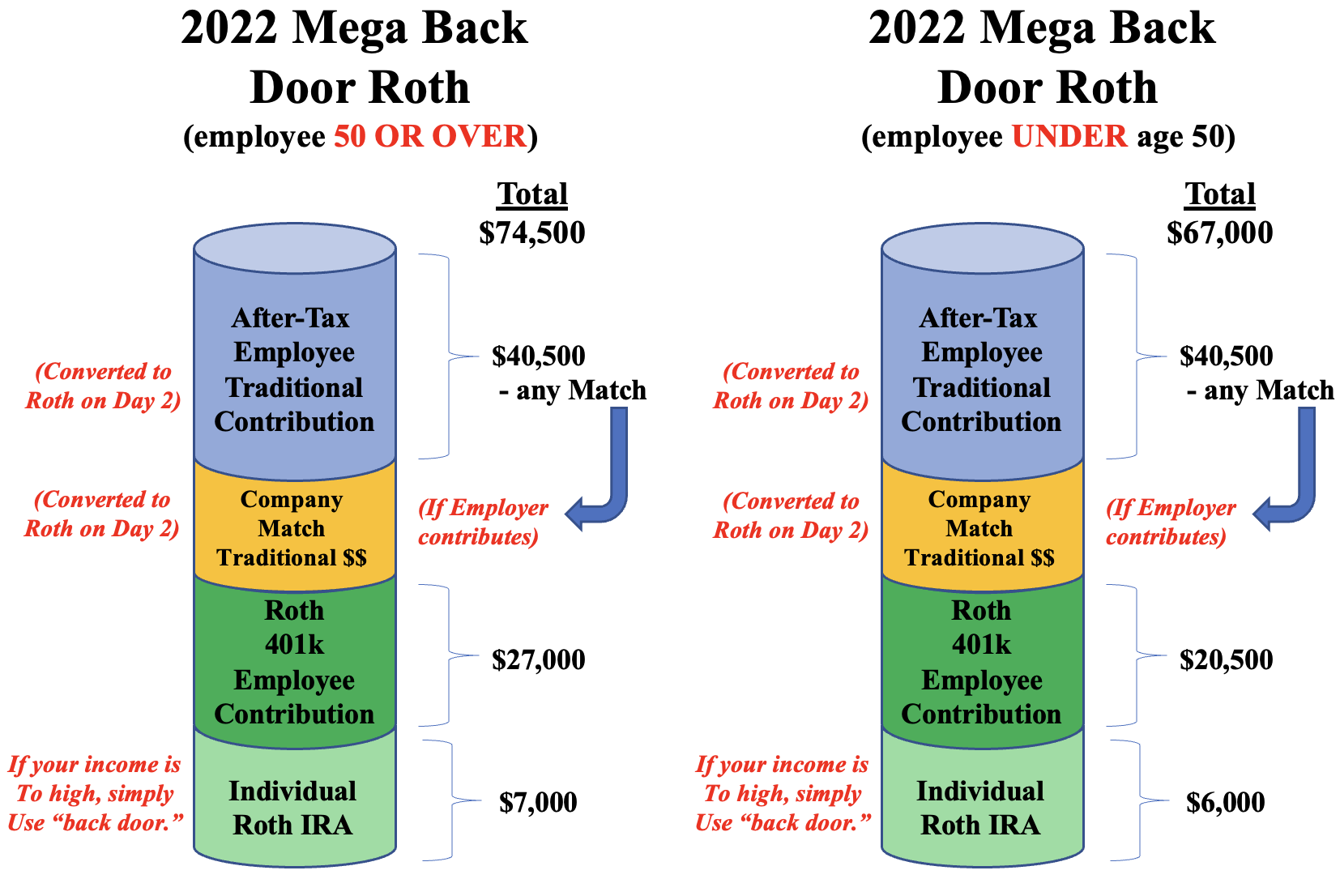

This is the total irs limit minus the 401(k) contribution. In 2024, roth ira limits mean you cannot contribute directly to a roth ira if you’re single and have a modified adjusted gross income of more than $161,000 or are.

$8,000 If You're Age 50 Or Older.

$7,000 if you're younger than age 50.

It’s $69,000 In 2024 That You Can Get All In Into Your 401 (K).

While direct contributions to a roth ira are limited to taxpayers with income in excess of $146,000 ($223,000 for married taxpayers, 2024), those whose income exceeds these.

I Completed A Back Door Roth For 2024 And Transferred The Entire 7K Balance From My Newly Created Traditional Ira To The Roth Several Weeks.

Images References :

Source: rgwealth.com

Source: rgwealth.com

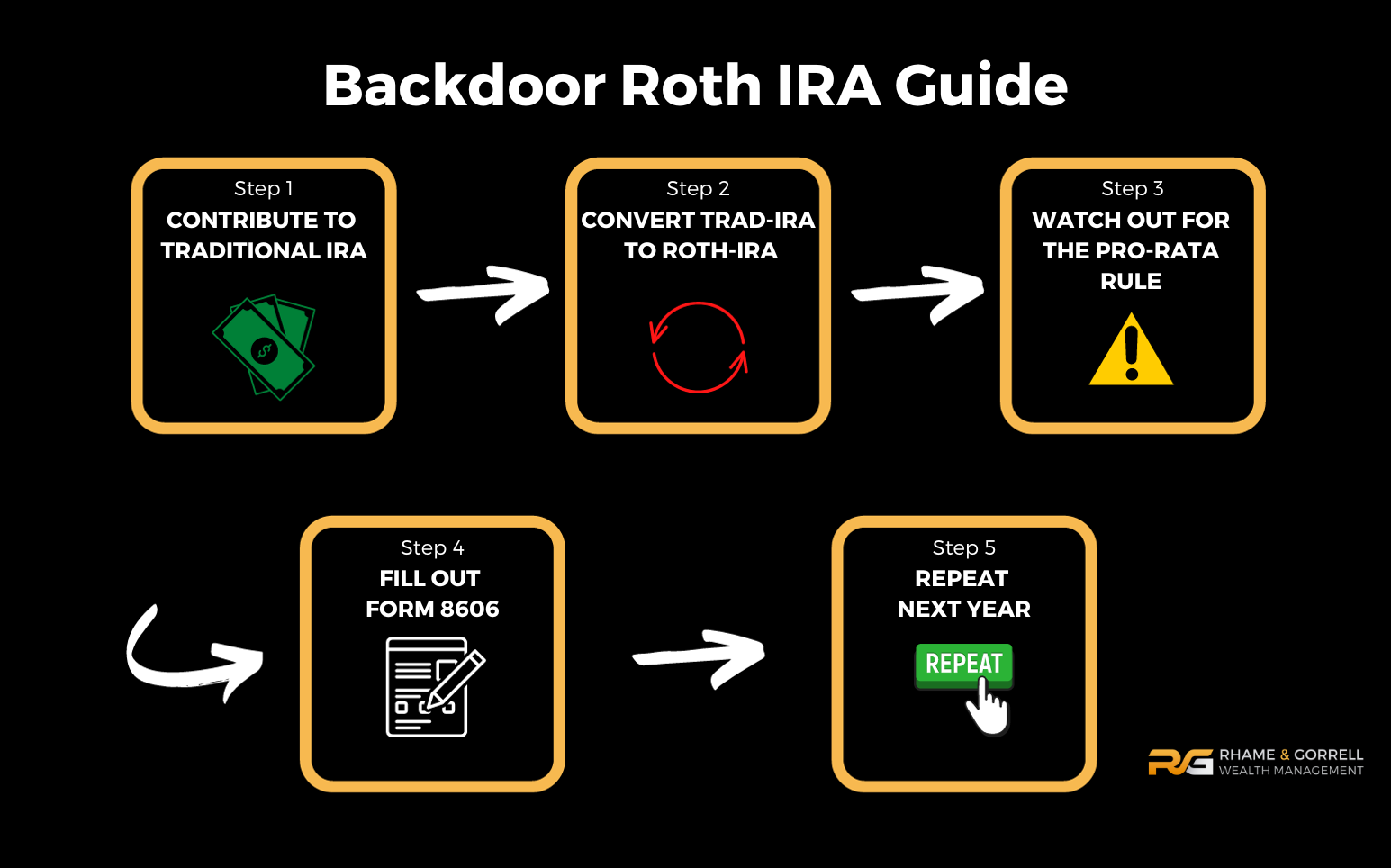

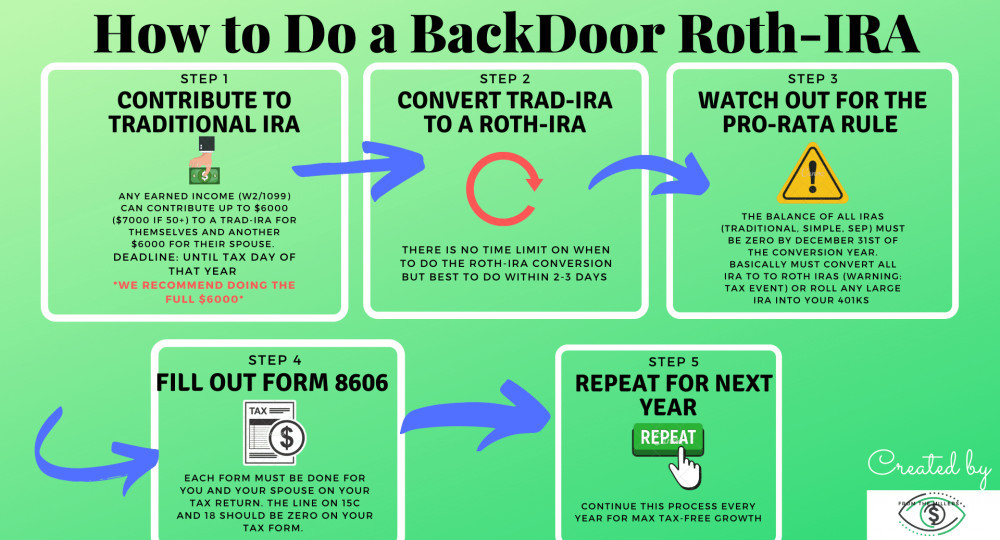

Backdoor Roth IRA Benefits, Intricacies, and How To Do It, For 2024, the following are the income limits on the ability to contribute directly to a roth ira. However, there has been talk of eliminating the backdoor roth in.

Source: www.youtube.com

Source: www.youtube.com

Simple Back Door ROTH IRA Guide 2024 (TAX FREE FOR LIFE!) YouTube, While direct contributions to a roth ira are limited to taxpayers with income in excess of $146,000 ($223,000 for married taxpayers, 2024), those whose income exceeds these. This is a 2024 backdoor roth tutorial, so i put the $7,000 into the 2024 column.

Source: markjkohler.com

Source: markjkohler.com

The Magic of the Mega Backdoor Roth Mark J. Kohler, For 2024, the following are the income limits on the ability to contribute directly to a roth ira. A backdoor roth ira isn’t a special type of account.

Source: www.threeoakswealth.com

Source: www.threeoakswealth.com

How to Use the Back Door Roth IRA in 2023 Three Oaks Wealth, Mega backdoor roth limit (2024) the mega backdoor roth limit for 2024 is $46,000, regardless of your age. Implementing a backdoor roth ira involves several key steps that high earners should follow to maximize the benefits of the strategy.

Source: buildingtowardswealth.com

Source: buildingtowardswealth.com

Is BackDoor Roth Going Away? Building Towards Wealth, That would consist of your own pretax or roth contributions, your employer contributions, and what. For determined savers, the backdoor roth ira is an important tool.

Source: bluebellpwm.com

Source: bluebellpwm.com

Your Guide To Back Door Roth IRA Montgomery County Blue Bell PWM, For determined savers, the backdoor roth ira is an important tool. Rather, it’s a strategy that helps you move money into a roth ira even though your annual income would.

Source: insights.wjohnsonassociates.com

Source: insights.wjohnsonassociates.com

How Mega Backdoor Roth Contributions Can Boost Your Retirement Savings, However, there are some income limits and other requirements that. In what appears to be a significant change, the secure act 2.0 enacted in december 2022 did not have language eliminating the backdoor roth strategy in the drafting phase or final legislation.

Source: personalfinancewellness.com

Source: personalfinancewellness.com

What Is A Backdoor Roth IRA? How Does It Work In 2021? Personal, Implementing a backdoor roth ira involves several key steps that high earners should follow to maximize the benefits of the strategy. That would consist of your own pretax or roth contributions, your employer contributions, and what.

Amazon Mega Backdoor Roth Sophos Wealth Management, So if your magi for the 2024 is less than $146k (single filer) or less than a total between the two of you of $230k (married filer), then you have no need to employ. A contribution using this backdoor roth ira strategy.

Source: insights.wjohnsonassociates.com

Source: insights.wjohnsonassociates.com

How To Use a Backdoor Roth for TaxFree Savings, I completed a back door roth for 2024 and transferred the entire 7k balance from my newly created traditional ira to the roth several weeks. That would consist of your own pretax or roth contributions, your employer contributions, and what.

Note That $7,000 Is $500 More Than You Could Contribute In 2023 And $1,000.

Implementing a backdoor roth ira involves several key steps that high earners should follow to maximize the benefits of the strategy.

A Backdoor Roth Ira Lets You Convert A Traditional Ira Into A Roth Ira, Which Could Save On Taxes.

Sinai free synagogue was live.